Navigating the process of filing for nonprofits can be challenging. Each nonprofit entity has its unique objectives, structures, and regulatory requirements to adhere to, which can make obtaining 501(c)(3) tax-exempt status a complex endeavor.

While other providers may charge $99 or more, that's not the case with us. We provide genuine, no-cost nonprofit formation. Our efficient processes enable us to maintain affordability, helping you save money. Form your nonprofit organization for $0 with us and reclaim your time to concentrate on what truly counts.

Since 2004, we've assisted over 1,000,000 entrepreneurs and small business proprietors in establishing and expanding their enterprises. Benefit from our top-tier support and a plethora of other incredible advantages to commence your business with confidence.

Included at no additional cost in our Gold and Platinum formation packages; Receive your EIN within just one business day.

Access affordable, tailored business formation services. Because every dollar is crucial when you're launching a business.

Every Incofile formation package comes with support for drafting, preparing, and filing Articles of Organization.

You don't have to engage a lawyer. Craft your corporation bylaws using our nonprofit incorporation kit.

Secure a business banking account, domain name, and business email swiftly with the Platinum package.

Receive email & text notifications, order updates and free lifetime compliance alerts within your dashboard.

Gain access to our comprehensive and user-friendly Registered Agent service at no cost for an entire year (subsequently $119 annually).

No need to hire an attorney. Create your corporation bylaws using our nonprofit incorporation kit.

Receive the finest user experience and unmatched value for your investment. No one offers you greater value for less.

Engage in a conversation with a dedicated incorporation specialist, not a sales representative, and receive lifelong customer support.

Access supplementary services directly from your business dashboard, ready and available when you require them.

Engage with a dedicated incorporation specialist, not a sales representative, and enjoy lifelong customer support.

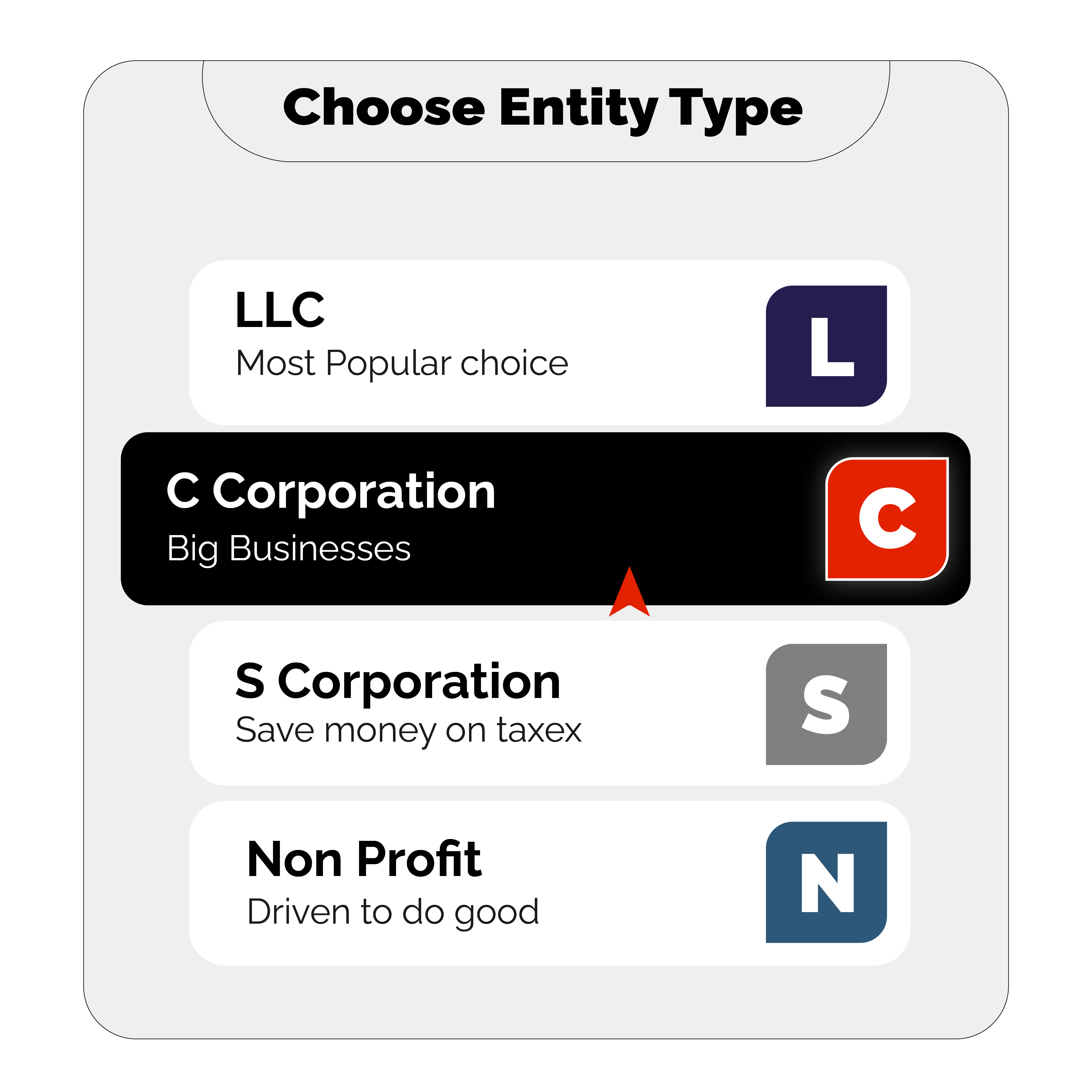

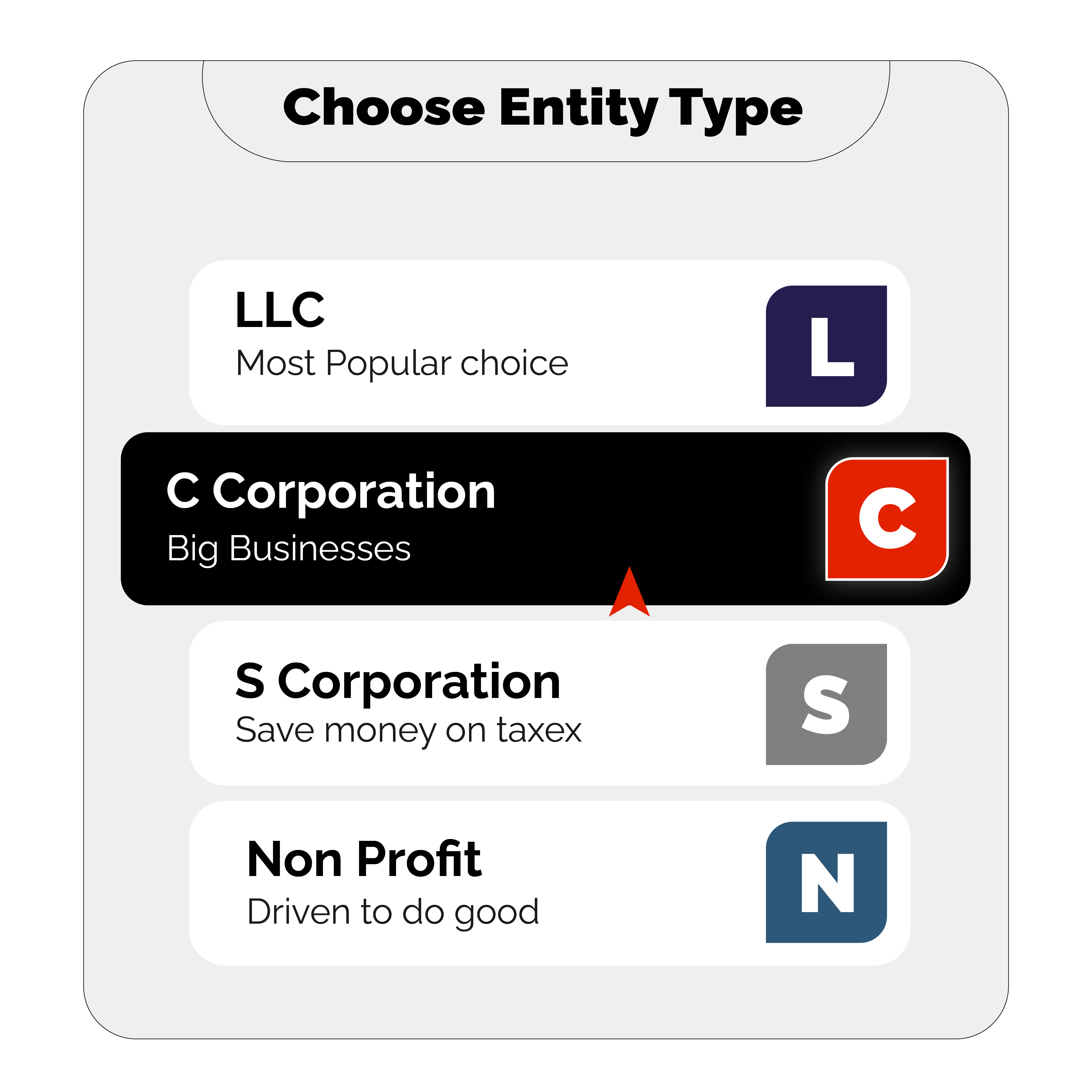

There are four primary types of nonprofits, each with slightly different objectives and corporate structures, all of which enjoy tax-exempt status. These include: 1. Public Charities/501(c)(3) Organizations 2. Social Advocacy Organizations 3. Foundations 4. Trade & Professional Organizations.

Whether you seek fundamental services or desire comprehensive business support, Incofile offers the perfect business formation package to assist you in initiating and expanding a nonprofit organization.

Complete the straightforward online order forms and furnish us with the necessary information about your nonprofit and the services you require. This enables us to prepare and file your incorporation documents efficiently.

Gain access to your user-friendly and intuitive business dashboard, allowing you to review your order details and verify that everything is accurate and in order.

Access your filed articles, as well as any supplementary documents and services, directly from your personalized business dashboard. We'll notify you as soon as they become available.

Preparing Documents...We'll compile your information, create your Articles of Organization or Incorporation and then file them with the governing agency in your state.

Preparing Documents...That trust incofile to start, manage and grow their business