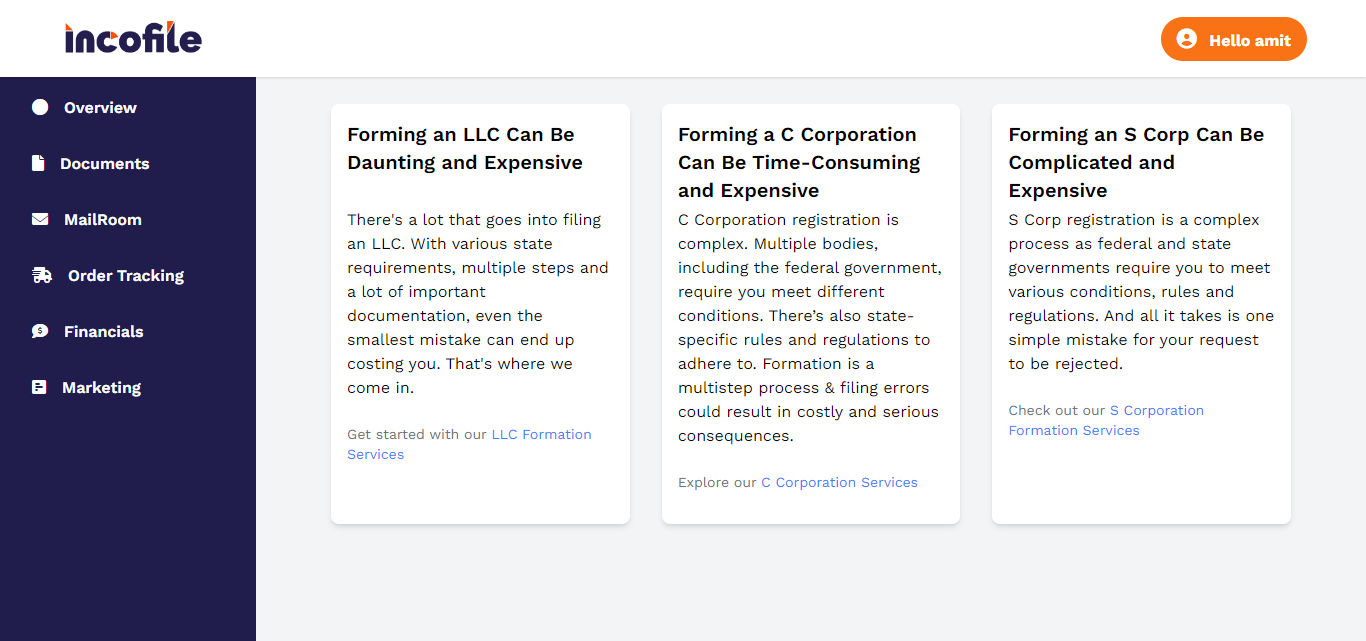

The process of registering as an S Corporation is intricate, involving numerous federal and state mandates, conditions, and regulations. A single error can lead to the denial of your application.

While others might charge upwards of $149, our services come at no cost to you. Our efficient processes allow us to maintain low overheads, enabling us to transfer these savings directly to you. Establish your S Corp with us without spending a dime, allowing you to focus your precious resources and energy on what truly counts—expanding your business.

Since 2004, we've assisted over 1,000,000 entrepreneurs and small business proprietors in launching and expanding their ventures. Benefit from our top-tier support—and a plethora of other incredible perks—to kickstart your business with assurance..

Free

Included at no extra cost in our Gold and Platinum formation packages, receive your EIN within just 1 business day.

Access affordable, customized S Corp setup. Every dollar is crucial when launching a business.

Every Incofile formation package comes with assistance in drafting, preparing, and filing your Articles of Incorporation.

Gain access to our straightforward Registered Agent service at no cost for an entire year (subsequently $119 annually).

No one offers you greater value for your investment. Obtain unmatched value for your funds and enjoy the finest user experience.

Take advantage of lifelong customer support. Engage with devoted incorporation experts, not sales representatives.

Receive email and text notifications, stay updated on order progress, and access free lifetime compliance alerts within your dashboard.

All key business tools in one spot for instant access. Get what you need, when needed."

Consult with a business tax professional at no cost as part of our Gold and Platinum formation packages.

There's no requirement to engage a lawyer. Utilize our nonprofit incorporation kit to formulate your corporation bylaws.

Secure a business banking account, domain name, and email swiftly with the Platinum package.

Select any supplementary S Corp services from your business dashboard as the need arises.

Guarantee the airtightness of all your contracts, documents, and forms without the expense of retaining legal counsel.

Opt for S Corp election and enjoy tax savings for your business.

Regulations and requirements differ by state, so it's important to carefully consider which state aligns with your business needs. You're not obligated to select the state you reside in; there are alternative options available.

Whether you require only the essentials or desire comprehensive business assistance, Incofile offers the perfect business formation package to facilitate the launch and expansion of your corporation.

Whether you're seeking fundamental services or require more comprehensive business support, Incofile offers the perfect business formation package to assist you in commencing and expanding your corporation.

Review the Specifics of Your Order

Access your user-friendly and intuitive business dashboard, allowing you to examine your order details and verify that everything is in order.Obtain Your Filed Documents in Your Dashboard

Access your filed articles, as well as any supplementary documents and services, directly from your tailored business dashboard. We'll notify you as soon as they become available.